Happy Saturday Housing Heroes!

Rental house owners in California may be sitting on a gold mine, and the reasons are more compelling than ever.

The most attractive rental property type has always been the classic 3-bed, 2-bath house with a garage and a yard. This style checks all the boxes for what renters desire—space, privacy, and functionality.

While California’s rental legislation can be a headache for landlords, most of the heavy regulations and restrictions currently apply primarily to multi-family properties, assuming Prop 33 doesn’t pass.

The challenge with investing in single-family home rentals in hot markets like San Diego and Orange County today is straightforward:

They don’t generate enough cash flow.

Property prices are so high relative to the rental income they can produce that the numbers simply don’t add up for new buyers.

I haven’t had a client purchase a single-family home rental in these areas for several years now for precisely this reason. However, for those who bought their properties years ago or inherited them, the story is different. With a competent property manager, rental rates naturally increase over time, debt is gradually paid down, and the property ultimately begins to yield positive cash flow.

Recent data shows single-family homes are becoming scarce. In early 2024, there were 31,653 single-family housing permits—a 13% increase from late 2023 and 14% above the 10-year average. Yet, during past real estate booms like we have today, builders were issuing over 80,000 permits in the first half of the year, compared to just 30,000 today—a 60% decrease. Despite a recent increase, the supply of new single-family homes remains low.

With ongoing immigration and demand for areas like San Diego and Orange County, there’s a growing pool of renters and buyers competing for fewer single-family homes. These single family home rentals will continue to be in high demand and appreciate more rapidly than other types as they are more rare.

Reflecting on this, I recall a lesson from when I was 18. My father told me my Grandma left me some Gold bullion. He said I could hold onto it or sell it. I asked him how much it was worth per oz. He said $300. I said, “Sold!”

Little did I know the price would rise 5x over the coming years. This taught me the importance of understanding a rare asset’s long-term value.

In conclusion, single-family rental homes are becoming rare, like collector coins. As population growth outpaces new construction, these properties will likely see significant value increases. If you own one—or have the chance to invest—you might be sitting on a gold mine.

Source: San Diego Union-Tribune

San Diego is ranked #2 in the country for rising home prices! Check out the video below where Jason Lee and I dive into what this 👇

Key Highlights of the video

- San Diego is ranked #2 in the country for rising home prices!

- Even with fluctuating interest rates, homes are still flying off the market, especially those with yards and 3 bedrooms.

- If you’re eyeing an investment, 2-4 unit properties are a great opportunity right now.

|

|

Have questions about managing your property?

My team is here to support you. Schedule a call with us, and let’s chat about how we can help you navigate your property management journey.

|

Free Tools

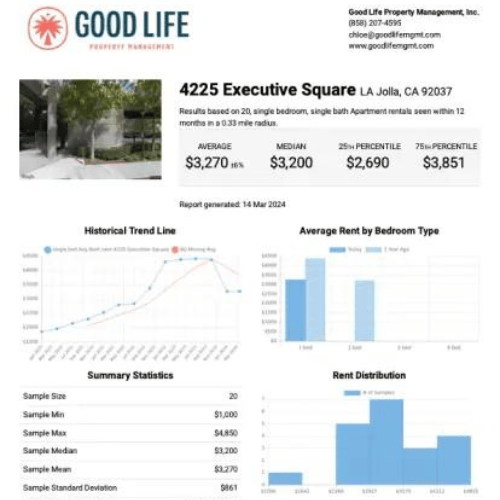

Get your Instant Rent Estimate

|

|

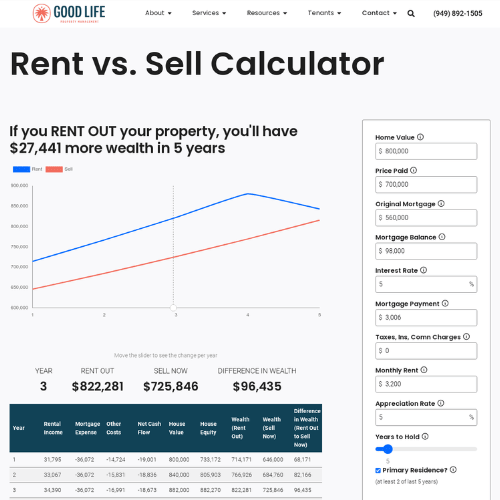

Rent vs Sell Calculator

|

That's it for this week! We hope you enjoyed the content and found it useful. Be sure to check your inbox next Saturday at 6 AM for our next update. Have a fantastic week!

P.S. Please share this newsletter with a friend, so they can join the conversation.

|

|

Steve Welty

CEO @ Good Life Property Management

DRE #01744610

|