California's insurance market is in a state of crisis, with significant parallels to the ongoing challenges in the state's housing market. Both crises share a common thread:

Here’s an in-depth look at the situation and its broader implications.

Understanding Proposition 103

Proposition 103, passed in 1988, was designed to protect consumers from unjust rate hikes across auto, property, life, and casualty insurance. While well-intentioned, these regulations have led to significant challenges in the insurance market:

- Rate Adjustment Limitations: Insurers face substantial red tape when seeking to adjust rates in response to rising risks and costs. This makes it difficult for companies to stay profitable and respond to market conditions.

- Mandatory Rollback and Discounts: Insurers were mandated to roll back rates by 20% and offer a 20% discount to "good drivers." This government-mandated pricing interferes with natural market competition that could better regulate these discounts.

- Public Intervention: The public can challenge rate increases and intervene in regulatory proceedings, adding more red tape and market congestion. This results in slower response times to market changes and higher administrative costs.

- Wildfire Modeling Exclusion: Insurers cannot use wildfire modeling for rate calculations, preventing them from accurately forecasting future risks. Businesses need to look forward, not just backward, to remain viable. Not allowing insurers to set market prices makes the market more unhealthy.

Other Factors Contributing to the Crisis

While Prop 103 is a significant factor, other elements have also contributed:

- Increased Wildfire Risks: Recent years have seen catastrophic wildfire losses, which have significantly impacted insurance costs and availability.

- Rising Construction Costs: The cost of construction materials has increased by nearly 40% from January 2019 to June 2023, making it more expensive to rebuild homes and businesses.

- Higher Reinsurance Prices: Property reinsurance premiums have risen by 50% from April to July 2023, adding another layer of cost for insurers.

These factors are exacerbated by Prop 103's restrictions, limiting insurers' ability to adjust rates quickly and forcing some to leave the state altogether.

What's Being Done to Fix It?

California Insurance Commissioner Ricardo Lara is working on new regulations to stabilize the market:

- Streamlined Rate Reviews: Efforts to make the rate review process more efficient aim to reduce the time and bureaucracy involved in adjusting insurance rates.

- Catastrophe Modeling: Allowing insurers to use catastrophe modeling to set premiums combines historical data with projected risks, offering a more accurate assessment of future threats.

Despite these efforts, it may take 1-1.5 years for these changes to positively impact the market.

These Insurance Companies are Just Greedy Corporations, Right?

Similar to the housing crisis, some in the media blame greedy landlords for high rental prices. Insurance companies, I would bet, are not the "greedy corporations" some media outlets portray them to be. Rather, they are businesses that exist to make a profit and can't price policies in a profitable way, due to regulatory constraints. So many are choosing to not do business in California.

Take State Farm, for example. The company lost over $1 billion last year and was downgraded from an A rating to a B rating. This significant financial hit underscores the challenges insurers face in trying to operate within the existing regulatory framework.

Just like housing providers, insurance companies have a duty to remain profitable and stay in operation. Overregulation hampers their ability to manage risks and set prices effectively, ultimately leading to a less healthy market for both consumers and businesses.

Lessons for Housing Providers

This insurance crisis offers several key lessons:

- Overregulation Increases Prices and Market Chaos: Striking a balance between necessary regulations and market freedom is essential to avoid unintended consequences.

- Business Pricing Autonomy: Businesses need flexibility in pricing to manage risks effectively and maintain viability.

- Need for Market-Driven Approaches: In today's world, with the internet and AI, more value is created faster. Less regulation is needed, not more. If a business is not treating consumers well, other businesses will quickly step in to take market share. Less regulation encourages innovation and competition. I am supporting candidates who share this vision of more market-driven approaches to our biggest problems.

How to Secure Affordable Coverage

To navigate this challenging environment, consider the following steps:

- Plan Ahead: Be aware of when your policies expire and plan accordingly. You need time to shop and compare rates.

- Use a Broker: Consider using brokers like Pacific Premier Insurance to get comprehensive coverage. This is who I use for all my personal and business insurance. I love having everything kept in a spreadsheet for me and having a company that can help me navigate the market. I don’t get anything for this endorsement. There are many brokers out there, but know that they usually won’t just write one or two policies. They want to be your one-stop shop as they make their money managing people's entire insurance needs.

- Explore Online Options: Look into online platforms like Obie or Steadily for landlord insurance. Many of our clients have found coverage through Obie and were happy with the process. I can’t speak to how well they service claims, but they have a streamlined process to underwrite and offer insurance.

If you have stories you would like to share to help our community, please email me. Together, we can navigate these challenges and continue to thrive as a community of housing providers.

Homeowner's Guide to Surviving in a Challenging Market

Free Tools

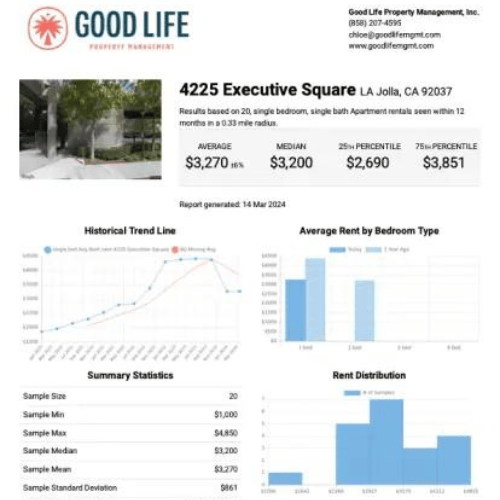

Get your Instant Rent Estimate

|

|

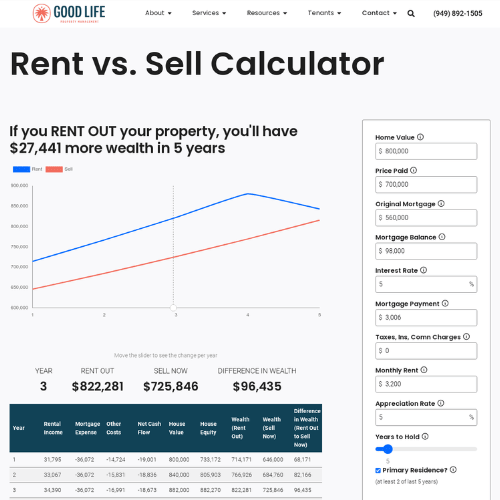

Rent vs Sell Calculator

|

Recent Articles

What is the California Home Insurance Crisis?

As a leader in property management, Good Life has been closely observing the California home insurance crisis over the past few years. These changes are more than just industry trends. Rather, they directly impact the way homeowners and property investors will approach their insurance needs in California.

Read more →

|

|

Free Rent Invoice Template for Landlords

If you have a rental property, rent invoices should be a part of your payment process. Get our free rent invoice template and learn how to use it effectively.

Read more →

|

That's it for this week! We hope you enjoyed the content and found it useful. Be sure to check your inbox next Saturday at 6 AM for our next update. Have a fantastic week!

P.S. Please share this newsletter with a friend, so they can join the conversation.

|

|

Steve Welty

CEO @ Good Life Property Management

DRE #01744610

|