Happy Saturday Housing Heroes!

We celebrated my grandma’s 95th birthday with a fabulous 1920s-themed party at the VFW in Moreno Valley, and it was a blast! Seeing her dancing energetically in her wheelchair was not just heartwarming, but also a testament to her enduring spirit.

Born in 1929, she has witnessed almost a century of economic ups and downs, including the Great Depression, World War II, and countless recessions. Her journey got me thinking:

How does the housing market of her birth year compare to today’s?

In 1929, the world was on the brink of the Great Depression. The median household income was about $2,000 annually, while the median home price was around $7,000. This translates to a housing affordability ratio of 3.5, meaning the cost of a home was 3.5 times the median annual income.

Even then, homes were slightly above the “affordable” range, often cited as 2.5 to 3 times one’s annual income. Despite this, many people still managed to buy homes, often with the help of then-newly available credit products and a booming economy—until it all came crashing down.

Fast forward to today. The median home price in 2024 is a staggering $416,000, while the median household income is around $74,580. This brings the affordability ratio to 5.58, meaning that homes today are 60% less affordable than at the height of the 1929 market boom.

This stark difference highlights the immense challenges facing potential homebuyers now. With home prices having surged due to high demand, limited supply, low interest rates over the past decade, and recent inflation spikes, it’s no wonder tenants feel they’ll never escape the rent trap. Many are priced out of buying, which further drives up rental prices as more people compete for rental properties.

The market today feels unsustainable, and we might be on the brink of a correction. Just like in the years leading up to the 2008 financial crisis, today’s market is characterized by a sense of inevitability that prices will stay high or even rise further.

However, cracks are starting to show. Credit card debt is at an all-time high, interest rates are climbing, and a significant portion of the population simply cannot afford to buy a home.

This situation brings to mind the concept of a “domino effect” in real estate. For a $10 million house to sell, there must be a buyer for an $8 million house, who themselves rely on a buyer for a $6 million house, and so on down to the entry-level homes. If buyers pull back at any level—especially the entry level, where the bulk of the market lies—the entire chain breaks down, and sales stall across all price points. This can lead to a situation where prices must fall to make homes affordable again and restart the transaction chain.

Reflecting on my own career, I remember starting in real estate in 2006 and thinking that prices were out of control. I felt much like today’s buyers—hopeless, believing I’d never be able to afford a home.

Yet, when the market crashed in 2007, it provided a unique opportunity for those who had been patient and prepared. I was able to buy my first home after the crash, and it taught me a valuable lesson: the market is cyclical, and opportunities often come when everyone else has given up hope.

The current sentiment is similar to the pre-crash days of 2008. Many have accepted that the market will remain unaffordable indefinitely, but that’s often when corrections are just around the corner. With rising mortgage rates making borrowing more expensive and the economy facing uncertainty, we could be headed for a cooling-off period or even a significant correction.

For aspiring buyers, my advice is simple:

Stay informed, stay prepared, and don’t lose hope.

If history is any guide, a more favorable buying market could emerge in the next few years. For now, it’s about playing the waiting game, but when the opportunity knocks, you want to be ready to answer.

Catch this week’s IG Live with Heather Ferbert

Heather is running for City Attorney for San Diego, bringing her commitment to justice and community-focused leadership to local government. She combines her background in psychology with practical strategies to drive growth, build effective communication, and lead purposeful change.

Recent Articles

How to Get Your Property Rent-Ready

With experience preparing over 1,000 properties for listing, these are the 7 things you need to do to attract the best tenants and achieve the highest rent.

Read more →

|

|

How to Become a Landlord: The Ultimate Guide

In this guide on becoming a landlord, we’re sharing everything you need to know about the transition so you know what to expect from day one.

Read more →

|

Free Tools

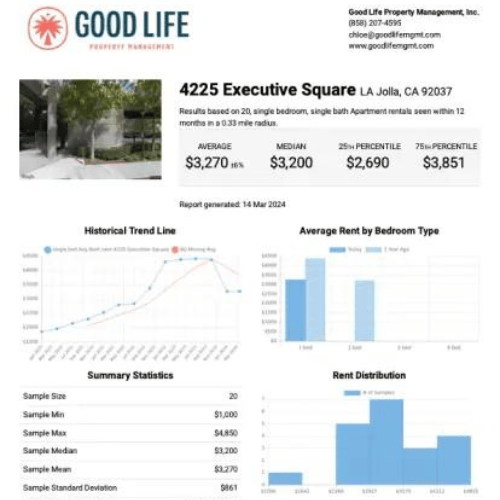

Get your Instant Rent Estimate

|

|

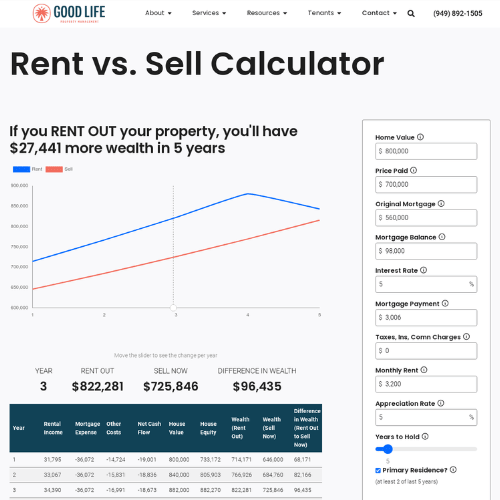

Rent vs Sell Calculator

|

That's it for this week! We hope you enjoyed the content and found it useful. Be sure to check your inbox next Saturday at 6 AM for our next update. Have a fantastic week!

P.S. Please share this newsletter with a friend, so they can join the conversation.

|

|

Steve Welty

CEO @ Good Life Property Management

DRE #01744610

|